I grew up in NY where no such thing existed. Here in Ma each year I pay close to $700 to have the privilege of driving on some of the worst roads and poorest infrastructure in the U.S. How many states have such a thing or is it that other states get it out of you via a higher gas tax than we have here?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Car Excise Tax

- Thread starter bavbob

- Start date

In Fairfax County Virginia (suburban Washington DC), there is an annual property tax on motor vehicles that applies at a rate of 4.57% of blue book value. If you register your car as an antique, however, there is no personal property tax. Antique vehicles are also exempt from emissions and state safety testing.

jmackro

Well-Known Member

How many states have such a thing or is it that other states get it out of you via a higher gas tax than we have here?

California's model is low vehicle fees / high gas taxes. Our vehicle fees are paid through the annual registration cost and are calculated based on the vehicle's value. New cars are a few hundred per year, for older or vintage cars that comes down to several tens. But our gasoline taxes are $.7358/gallon - diesel taxes are $1.10.

In some ways, that is sort of fair: people owning older cars that aren't driven very much aren't penalized. But you could challenge the magnitude of the fuel tax and what percentage of it actually gets spent on road maintenance and construction.

Last edited:

I am always interested at how each state collects their 'operating funds'. Always through taxes, but each state has a different recipe. For example, Illinois has toll roads, whereas Wisconsin doesn't. But Wisconsin has wheel taxes. What is most interesting, I find, is when someone moves from one location to another so they don't have to pay "such and such" tax. But you end up paying it one way or another. I say, pick your location for the qualities of that location, climate, proximity to family and friends, etc.

Connecticut it's called Property Tax. Wasn't too bad, there was no State Income Tax at the time we were living there.

Maine it's called Excise Tax, this is levied by the town as a road use tax, pays for snow plows & salt. Town also collects Sales Tax on any vehicle sale.

Massachusetts earned the nickname Taxachusetts. When I lived there I was not of age to pay any taxes.

Maine it's called Excise Tax, this is levied by the town as a road use tax, pays for snow plows & salt. Town also collects Sales Tax on any vehicle sale.

Massachusetts earned the nickname Taxachusetts. When I lived there I was not of age to pay any taxes.

I am always interested at how each state collects their 'operating funds'. Always through taxes, but each state has a different recipe. For example, Illinois has toll roads, whereas Wisconsin doesn't. But Wisconsin has wheel taxes. What is most interesting, I find, is when someone moves from one location to another so they don't have to pay "such and such" tax. But you end up paying it one way or another. I say, pick your location for the qualities of that location, climate, proximity to family and friends, etc.

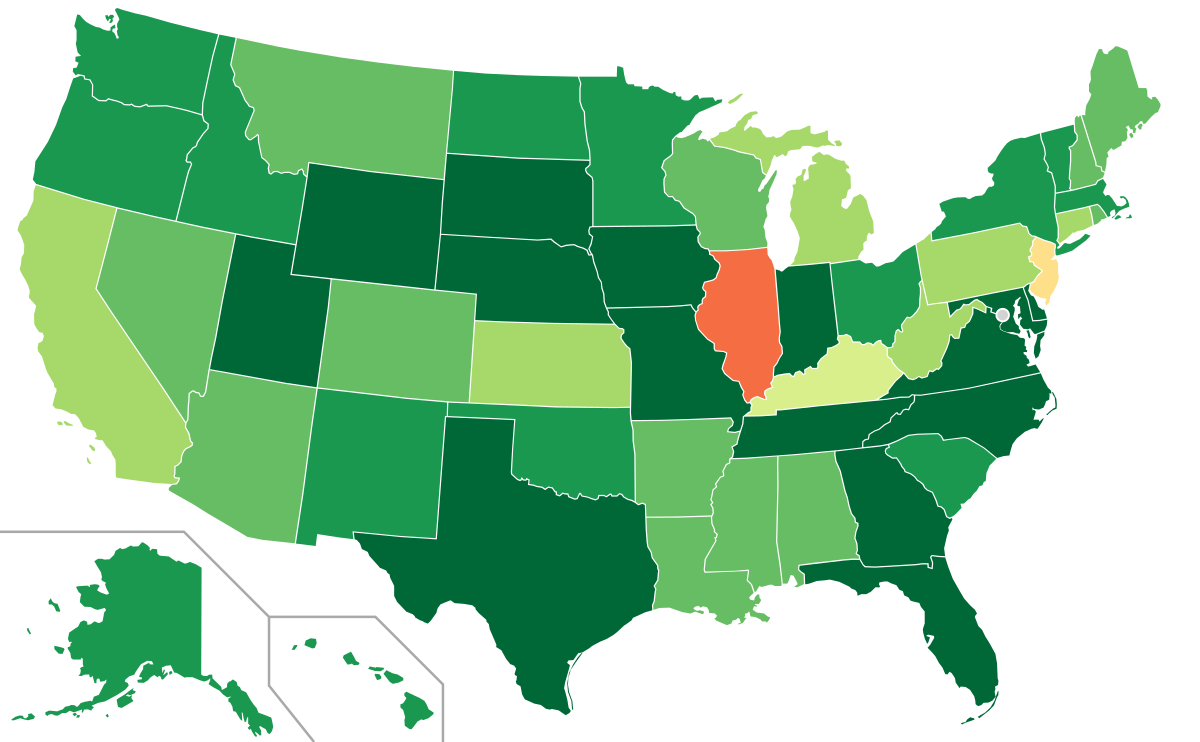

Here's a list of state budgets per capita...

List of U.S. state budgets - Wikipedia

I assume that most of the budget money is coming from state taxes and fees in one form or another, but some is probably also coming from the federal government and may be disproportionate to the state's population (high or low)

Surprisingly (to me), the highest state budget per capita is North Dakota. I take that to mean that state taxes per capita (sales tax, income tax, property tax, other taxes and fees) in North Dakota are the highest. Also surprisingly (to me), Wyoming is right up there.

Washington has no income tax and Oregon has no sales tax, but both budgets are higher than the average. That supports autokunst's point that "you end up paying it one way or another".

Massachusetts is about on the average but somehow gets the label of a high tax rate state. Maybe the way they get it is too visible?

In ALL cases, people don't like paying taxes and fees. I'm sure the people in the lowest budget per capita states (Iowa, North Carolina, Oklahoma, Pennsylvania) are complaining just as loudly as the rest of us.

People especially don't like paying taxes for services they don't use (example..."why should I support schools, I don't have any kids"), but we'll also complain when the taxes and fees are in direct proportion to usage (toll roads, bridge tolls, gas tax, State Park use fees, etc).

Whatever tax/fee system exists, we'd do it differently

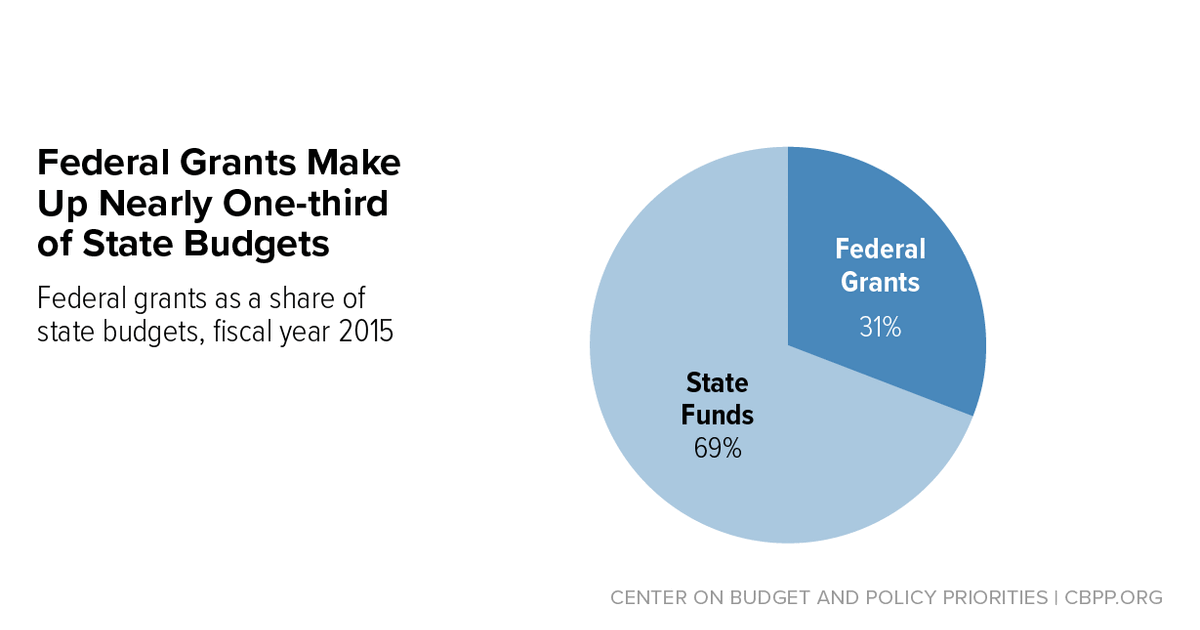

EDIT: I just found this...

At Risk: Federal Grants to State and Local Governments | Center on Budget and Policy Priorities

Programs for low- and moderate-income families could bear the brunt of the cuts.

www.cbpp.org

Last edited:

in georgia we have had (and still have for car bought before the new law) ad-valorem taxes ... in order to renew your license tag you paid a tax based on the value of the car ... and you had to pay it by your birthday when the tag renewed. it was called the 'birthday tax'. about 5 or 6 years ago they got rid of it and when you bought a car (new or used - private or dealer sale) you pay an ad-valorem sales tax - whether you buy it in state or out of state.

To be clear, the car taxes we pay in the DC area are redirected to "transportation." A substantial portion of these funds are siphoned off to Richmond and spread throughout Virginia. Roads around VIR are glorious. And the "transportation" funds that remain here are employed to fund improvements at the airports, Metro rail, bus service, endless poorly thought out signage, bike lanes in the roads, sound barriers along the interstate, and high maintenance pretty brick walkways at intersections.

The end result is that visitors to the capital city of the richest nation on the planet encounter roads that are only slightly better than a war torn third world country.

The end result is that visitors to the capital city of the richest nation on the planet encounter roads that are only slightly better than a war torn third world country.

The end result is that visitors to the capital city of the richest nation on the planet encounter roads that are only slightly better than a war torn third world country.

Well, we're #8 but that's still pretty good.

List Of Top 100 Richest Countries in the World

This is an updated list of top 100 richest countries in the world by GDP (nominal) per capita . One of the reliable ways of measuring a Nation’s wealth is through their GDP (which means Gross Domestic Product) per capita.

victormatara.com

I could go on about the lottery and marijuanna sales and all the cash this state takes in....but I guess all I want is to not have to buy a new alloy wheel every winter.

I could go on about the lottery and marijuanna sales and all the cash this state takes in....but I guess all I want is to not have to buy a new alloy wheel every winter.

The reason I own a truck is because I have to go into Washington DC from time to time.

There is a benefit to an SUV that most who drive them, don't even realize.