You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

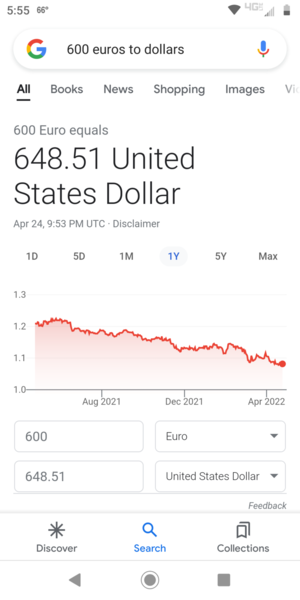

Euro to dollar

- Thread starter Thomas76

- Start date

hmmm?!!

Great - I'm in! What are we buying in bulk.

Oh good the thing I wanted but didn’t need has sold!

I had some the mental math if 1,600 € plus crappy conversion rate plus shipping = get your priorities straight…

I had some the mental math if 1,600 € plus crappy conversion rate plus shipping = get your priorities straight…

Well, the Russian ruble hit a 2 year high today against the Euro.

It may mean many things, and most of them are not good.

It may mean many things, and most of them are not good.

Rek

Well-Known Member

Caused by the foreign purchase of Russian oil having to be in in rubles I would think.

Probably. The risk profile may be reflected by the bond yield curve, not ruble value.Caused by the foreign purchase of Russian oil having to be in in rubles I would think.

2027 maturity is at 44%. 2023 are at 27 cents per dollar. The longest 25-year is 81%.

I am tempted

Rek

Well-Known Member

What did all that mean?

Rek

Well-Known Member

I go by standard economics rather than too complex speculation. Supply and demand are simple to understand. My thoughts were, why would anyone be buying rubles right now with the uncertainties affecting the economy and the liquidity via potentially failing banks. Well really only those who are forced the buy in a very large transaction, rubles to make the purchase. Oil/Gas?

Russia had money reserves of $B606 in March and $B611 by the end of April. That is indeed the energy export profits. If they get paid in rubles the demand for rubbles increases, if they get paid in dollars the supply of dollar increases in Russia. Both strengthen the ruble I believe. But I digress.I go by standard economics rather than too complex speculation. Supply and demand are simple to understand. My thoughts were, why would anyone be buying rubles right now with the uncertainties affecting the economy and the liquidity via potentially failing banks. Well really only those who are forced the buy in a very large transaction, rubles to make the purchase. Oil/Gas?

Explainer: EU's options to cut Russian oil imports - and their drawbacks

The European Union is considering options to cut imports of Russian oil as part of possible further sanctions against Moscow over its invasion of Ukraine, but none has been formally proposed as governments assess their impact.