i feel there is room for business here: I still have a teenager without an education and without a job: ... perhaps just BMW parts shipping? Is there not a way around- say, lease the parts for 100 years and then send the part back?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

This is messed up.. mail stopped to USA

- Thread starter sfdon

- Start date

nice idea but the laws on leasing generally face the same issues as owning - somebody has to pay the taxes / tariffs. if you import something, still has the same issues. the US gov't is good about getting their share. i am reading the current one on the USITC website (that is the group that maintains the schedule)i feel there is room for business here: I still have a teenager without an education and without a job: ... perhaps just BMW parts shipping? Is there not a way around- say, lease the parts for 100 years and then send the part back?

i have been reading (in my spare time) chapter 87 of the Harmonized Tariff Schedule. 8703 is about motor vehicles with an internal combustion engine.

section 8708 is about parts and accessories for motor vehicles of headings 8701 to 8705.

- <8708.10> bumpers + parts of bumpers - 2.5% rate 1 - general duty + 25% rate 2

- <8708.21 + .22> seat belts, windshields - 2.5% rate 1 - general duty + 25% rate 2

- <8708.30> brakes + servo brakes - 2.5% rate 1 - general duty + 25% rate 2

- <8708.40 + .50> gear boxes, drive axles - 2.5% rate 1 - general duty + 25% rate 2

- <8708.70> wheels, parts + accessories - 2.5% rate 1 - general duty + 25% rate 2

- <8708.80> suspension systems + parts - 2.5% rate 1 - general duty + 25% rate 2

- <8708.91> radiators + parts - 2.5% rate 1 - general duty + 25% rate 2

- <8708.92> exhaust + parts - 2.5% rate 1 - general duty + 25% rate 2

- <8708.93> clutches + parts - 2.5% rate 1 - general duty + 25% rate 2

- <8708.94> steering wheels, columns + boxes - 2.5% rate 1 - general duty + 25% rate 2

- <8708.99> OTHER - 2.5% rate 1 - general duty + 25% rate 2

so Don, i forgot to ask you today, how did it work out for you with C + BP (customs) coming home with the 'big' suitcases full of parts?

Global Entry is the way….

4 people in line no forms to fill out and no questions thank you goodbye.

4 people in line no forms to fill out and no questions thank you goodbye.

Don’t get a speeding ticket or you will lose your GE!

I got one and my GE is still in tact....Don’t get a speeding ticket or you will lose your GE!

My application for global entry was denied at first. I appealed.

Turned out it was something from crossing the border in 1978.

I asked him what was the situation? They didn’t know! And I didn’t remember either.

At that point, I said if I’ve been clean for over 40 years, can I have a global entry please.?

And they gave me my global entry.

I do understand that one of the criteria for getting global entry is a clean, driving record.

Turned out it was something from crossing the border in 1978.

I asked him what was the situation? They didn’t know! And I didn’t remember either.

At that point, I said if I’ve been clean for over 40 years, can I have a global entry please.?

And they gave me my global entry.

I do understand that one of the criteria for getting global entry is a clean, driving record.

I had no idea...I have mine and I guess I need to slow down...I do understand that one of the criteria for getting global entry is a clean, driving record.

I never knew that a clean driving record was a requirement. Yet another advantage to driving old BMWs that are fun at legal speeds!My application for global entry was denied at first. I appealed.

Turned out it was something from crossing the border in 1978.

I asked him what was the situation? They didn’t know! And I didn’t remember either.

At that point, I said if I’ve been clean for over 40 years, can I have a global entry please.?

And they gave me my global entry.

I do understand that one of the criteria for getting global entry is a clean, driving record.

Steve, there is guy here at Saratoga Springs who lost his due to a ticket and was telling us about it last night.

I'm getting all my tickets in Europe....

My insurance company still thanks I'm a Good Driver!

My insurance company still thanks I'm a Good Driver!

Mike Pelly

Well-Known Member

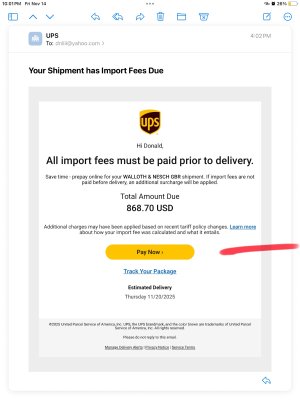

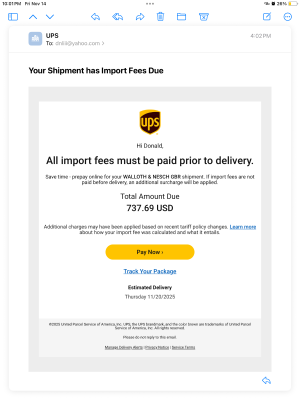

i just paid a $1,600 tariff on a $2,500 order from W/N. UPS also requested my SS# in order to process the transaction (In lieu of a tax I’d #). I made the order on Oct. 15, it will be one month tomorrow. Still waiting. W/N took more that three weeks to ship - I think they were purposely delaying because of all the problems with shipping to the USA

Absolutely unbelievable! These tariff stories are just amazing. Sorry to read your penalty was so excessive. Appears that there is no way to predict in advance what final tariff cost will be until you get the invoice. Sad.i just paid a $1,600 tariff on a $2,500 order from W/N. UPS also requested my SS# in order to process the transaction (In lieu of a tax I’d #). I made the order on Oct. 15, it will be one month tomorrow. Still waiting. W/N took more that three weeks to ship - I think they were purposely delaying because of all the problems with shipping to the USA

From my current experience, when it comes to shipping from Europe to the US, Fedex is probably the most honest option at the moment.

UPS is a bit of a mess...

DHL also has various problems, but it depends on the country from which the shipment is being sent.

However, with Fedex, so far, the recipient of my shipment hasn't been exposed to any significant additional costs.

If you're ordering something from Europe, I suggest asking the sender to ship via Fedex.

I should note that this applies to private purchases and shipments.

The situation may be different when it comes to purchases from companies, shops, etc.

Alternatively, you can always ask a friend in Europe to buy the necessary part from a given store or company and ask them to send it privately as a gift.

It's always an option...

UPS is a bit of a mess...

DHL also has various problems, but it depends on the country from which the shipment is being sent.

However, with Fedex, so far, the recipient of my shipment hasn't been exposed to any significant additional costs.

If you're ordering something from Europe, I suggest asking the sender to ship via Fedex.

I should note that this applies to private purchases and shipments.

The situation may be different when it comes to purchases from companies, shops, etc.

Alternatively, you can always ask a friend in Europe to buy the necessary part from a given store or company and ask them to send it privately as a gift.

It's always an option...

Don, what was the value of the order(s) for each of those UPS payments?And I just got my $1,600.00 worth of tariffs from Walloth today also.

If there was any standard that could be applied so you know what tariffs will be added, it would at least give the buyer the baseline knowing what he or she will be spending. This is straight out of the 3rd world handbook of - we will apply the tariffs that we want and f*&k you if you want to know why we are charging that amount. Next thing the government will be trying to take over private industry by "investing" in them.....oh wait.....

Don, what was the value of the order(s) for each of those UPS payments?

$1193.00

$1412.00

$2600.00 in orders

add currency conversion and shipping and broker fee and tariffs- $1800.00

Total cost $4400.00

That is my last order from Walloth shipping to USA. Everything goes to Portugal now.

My three recent orders from W&N have been all over the map. The first two that mainly had plastic and rubber parts, each totaling under $500, had a 50% tariff applied. As mentioned previously, W&N has been requesting that I send them the invoice with the tariff amounts so that they can write a letter which I will then forward on to UPS stating that they applied the tariff incorrectly, and theoretically I will get a return at some point. Meanwhile the new exhaust system that I ordered while they had them on sale last month is obviously 100% steel (stainless) so should have a 50% tariff, but I was only charged $42. I'm not complaining, mind you, but there's clearly something amiss in the UPS system.

In my back-and-forth with UPS over the first two orders, here's what I've learned:

1. They charge a tariff based on the total amount of the order but do not have a detailed invoice until about 2 weeks AFTER your product has arrived to you. Therefore they are obviously just guessing since they are charging without being able to tell you why they charged what they did.

2. The easiest way to get the detailed invoice is to call at exactly 8 AM EST when they open, and you want to call the UPS Business Invoice number which is 1-866-493-7140. When I've called at 5 AM my time (8 AM EST), my wait time is under 5 minutes whereas when I have tried in the middle of the day I've been on hold for over an hour and have had to give up. They will email you a copy of the invoice with details of tariff amounts charged and the HST codes applied. As mentioned above, that invoice will only be visible in their system for them to email it to you about 2 weeks after the order has been delivered.

3. Per emails with W&N, the process then is:

"To dispute the customs declaration, please send the following documents to [email protected] with a request to correct the customs declaration:

• Our attached commercial invoice, which shows the exact US customs tariff numbers

• The attached import invoice you received from UPS"

Hope this helps. It's all moot if we don't get paid back later, but at least the bureaucratic process has been made a bit more clear.

In my back-and-forth with UPS over the first two orders, here's what I've learned:

1. They charge a tariff based on the total amount of the order but do not have a detailed invoice until about 2 weeks AFTER your product has arrived to you. Therefore they are obviously just guessing since they are charging without being able to tell you why they charged what they did.

2. The easiest way to get the detailed invoice is to call at exactly 8 AM EST when they open, and you want to call the UPS Business Invoice number which is 1-866-493-7140. When I've called at 5 AM my time (8 AM EST), my wait time is under 5 minutes whereas when I have tried in the middle of the day I've been on hold for over an hour and have had to give up. They will email you a copy of the invoice with details of tariff amounts charged and the HST codes applied. As mentioned above, that invoice will only be visible in their system for them to email it to you about 2 weeks after the order has been delivered.

3. Per emails with W&N, the process then is:

"To dispute the customs declaration, please send the following documents to [email protected] with a request to correct the customs declaration:

• Our attached commercial invoice, which shows the exact US customs tariff numbers

• The attached import invoice you received from UPS"

Hope this helps. It's all moot if we don't get paid back later, but at least the bureaucratic process has been made a bit more clear.