My insurance company (State Farm) asked me for some current images and valuations. What do you think my car is worth and should be insured for? These are the images requested by SF.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What are you valuing your e9 for insurance purposes

- Thread starter scottevest

- Start date

Basically, if it were destroyed in an accident, what would it cost to find a reasonable good restoration candidate plus the cost from Benny to restore to the condition of your current E9.

That would be my "agreed value"

That would be my "agreed value"

It would be well in excess of $100,000 I believe to do that and that does not include all the time and effort chasing parts. Frankly I don’t know if Benny would do another one.Basically, if it were destroyed in an accident, what would it cost to find a reasonable good restoration candidate plus the cost from Benny to restore to the condition of your current E9.

That would be my "agreed value"

Recommend comparing agreed value with State Farm vs Hagerty. $100K coverage with Hagerty is $1608/year or $134/month. Your rate may vary.

I don't think you could get ANY insurance company to agree to the number that that process would produce.Basically, if it were destroyed in an accident, what would it cost to find a reasonable good restoration candidate plus the cost from Benny to restore to the condition of your current E9.

That would be my "agreed value"

Pretty sure my rate is much much less than that I will have to look but I think it is just a few hundred dollars to be honest because I don’t drive it that much and have several other cars insuredRecommend comparing agreed value with State Farm vs Hagerty. $100K coverage with Hagerty is $1608/year or $134/month. Your rate may vary.

Hagerty has my coupe insured for well over $100KI don't think you could get ANY insurance company to agree to the number that that process would produce.

That would probably be the market price for your car (I'm sure it is VERY nice). To buy a good restoration candidate and then to have it pro restored, is generally a bigger number in total than buying one already in the condition the restoration would produce.Hagerty has my coupe insured for well over $100K

I raised mine to $150.

Mine is $25,000.

Hello, Nice looking E9 and you don't see many black color is this an original color however I would give up this good looking E9 nothing less than $80,000 good lock with you and please do not get mad if I price it low if you put up an BAT to sale it it may go higher.My insurance company (State Farm) asked me for some current images and valuations. What do you think my car is worth and should be insured for? These are the images requested by SF.

View attachment 135448

View attachment 135449

View attachment 135450

View attachment 135451

View attachment 135452

View attachment 135453

View attachment 135454

FWIW, My insurance is up for renewal in March for 4 vehicles, so I thought I would quote American Collectors as they sounded like a lower cost option. I went on line and the first preliminary quote without details was 20% less than Hagerty. After adding items like occationally driving the cars for work (once a month) or errands (seldom) the price came back as identical to Hagerty. They asked for the current insurance company.

I will stay with Hagerty.

I will stay with Hagerty.

I just increased my value to $125,000. There are no clear restrictions on driving etc. It costs now about $500 a year with state farm

There are no clear restrictions is different than it is clear there are no restrictions on driving.I just increased my value to $125,000. There are no clear restrictions on driving etc. It costs now about $500 a year with state farm

I would love to know if they pay that $125k agreed value on a $500 a year policy when you use it for commute.

Maybe they know you spend so much time doing videos and interviews that you have no time left to drive the car

I don't commute anywhere for work at least. My house is above my office, but they never asked anyway. I drive to my hikes, and have 3 vehicles.There are no clear restrictions is different than it is clear there are no restrictions on driving.

I would love to know if they pay that $125k agreed value on a $500 a year policy when you use it for commute.

Maybe they know you spend so much time doing videos and interviews that you have no time left to drive the car.

I have 8 vehicles and they make me declare miles, and non-commute.I don't commute anywhere for work at least. My house is above my office, but they never asked anyway. I drive to my hikes, and have 3 vehicles.

House above office? More expensive as the upper floor may fall on the car.

You do not know your coverage until you total the car. Self insure, if the risk works for them it works for you.

zero chance of house ever falling; it is made of concrete, 18" thick walls.

I have 8 vehicles and they make me declare miles, and non-commute.

House above office? More expensive as the upper floor may fall on the car.

You do not know your coverage until you total the car. Self insure, if the risk works for them it works for you.

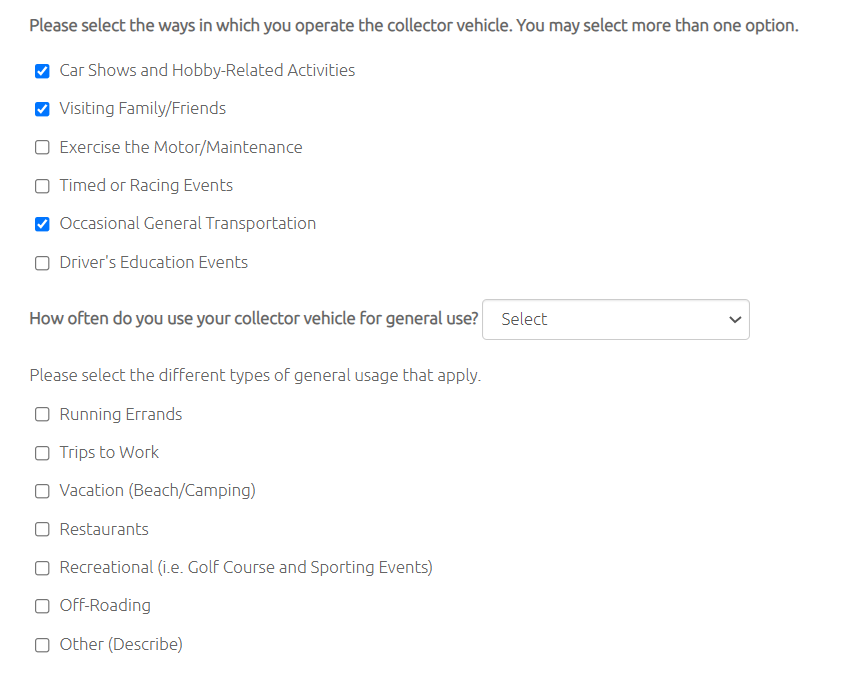

For transparency and information purposes only, here is where I believe "an insurance application" started costing more dollars. I would be incorrect to say that my cars will never visit friends, be used for general transportation, go to a resturant, other, or even to "Excercise the Motor/Maintenance, etc. Does anyone have an E9 or other classic car that doesn't need to be driven to "Excercise the Motor" or for "Maintenance? I believe the exceptions that they list are when an incident may be more likely to happen.

I clicked on only a couple boxes to expose the drop down below it.

I clicked on only a couple boxes to expose the drop down below it.

Oddly, I didn’t have to fill out any similar application.

I had trouble upping my agreed to value on my Sahara Coupe with State Farm to $70,000 a few years ago. Bring A Trailer at that point had a historical record of what Coupes were selling for at that time so I sent my agent and the underwriter the link to the values. Within a day or two they got back to me and agreed to what I wanted. Don't recall what my premiums are but I have several policies with them and it is reasonable and a single source. I should probably revisit the agreed to value but plan on selling Sahara sometime in the Spring. With all the sales that have gone on for Coupes at Bring A Trailer I think justifying a new value to any of the insurance companies should be easy now.

Regards, Jon

Regards, Jon